Midesk vs Brandwatch Consumer Intelligence

Deep social listening and analysis.

Consumer‑intelligence platform that collects and analyzes millions of social conversations across digital channels, using AI to surface insights and trends.1

Switching from Brandwatch Consumer Intelligence? Midesk adds multi-source scraping, adaptive clustering and AI-ready briefs so research teams can ship board updates in hours instead of days.

Vendor logo hidden until usage permissions are confirmed (uncertain).

Why teams switch from Brandwatch Consumer Intelligence

- Brandwatch focuses on social conversations (social media, blogs, forums) and does not ingest filings, tenders, job boards or competitor websites as Midesk does.13

- It provides dashboards and visualizations but does not create AI‑written briefs with clustering and citations.12

- The platform lacks a generic scraping pipeline to extract structured data from competitor sites.4

- Tenant‑scoped taxonomies and EU‑hosted governance features are not highlighted.2

Stick with Brandwatch Consumer Intelligence if…

- You need deep listening and AI‑powered analysis across social media and online conversations.

- You wish to upload first‑party social data for unified analysis.

Choose Midesk if…

- You require multi‑source market intelligence, including news, filings, tenders and competitor scraping, with AI‑written briefs.

- EU‑hosted governance and tenant‑scoped taxonomies are important.

Where Brandwatch Consumer Intelligence excels

- Access to one of the world’s largest archives of consumer opinions: 1.7 trillion historical conversations and 496 million new posts daily across social platforms, blogs and forums.1

- AI‑powered segmentation with generative AI search, image analysis and custom classifiers to surface insights quickly.1

- Ability to upload first‑party data into the platform for unified analysis.1

- Flexible analysis tools with dozens of interactive visualizations and exportable reports (Excel/PPT/PDF).1

Typical Brandwatch Consumer Intelligence use cases

Brand reputation monitoring

Track and analyse millions of social conversations to understand brand sentiment and emerging issues.1

Audience segmentation

Use AI‑powered search and custom classifiers to segment audiences and discover behavioural patterns.1

Trend discovery

Identify emerging trends and topics across the world’s largest archive of consumer conversations and act on them.1

Best suited for

- Marketing and PR teams needing deep social listening and sentiment analysis.

- Organisations that want to leverage large social datasets for consumer insights.

Not the right fit when

- Teams requiring multi‑source market intelligence that includes filings, tenders and competitor scraping.

- Users seeking narrative executive briefs with clustering and citation.

Comparison

Migration playbook

- 1Export social queries and saved dashboards from Brandwatch.

- 2Define equivalent topics and entities in Midesk and configure news and multi‑source monitoring jobs, including filings and competitor websites.34

- 3Use Midesk’s clustering and briefs pipeline to summarise findings, and schedule digests to stakeholders.2

See it in action

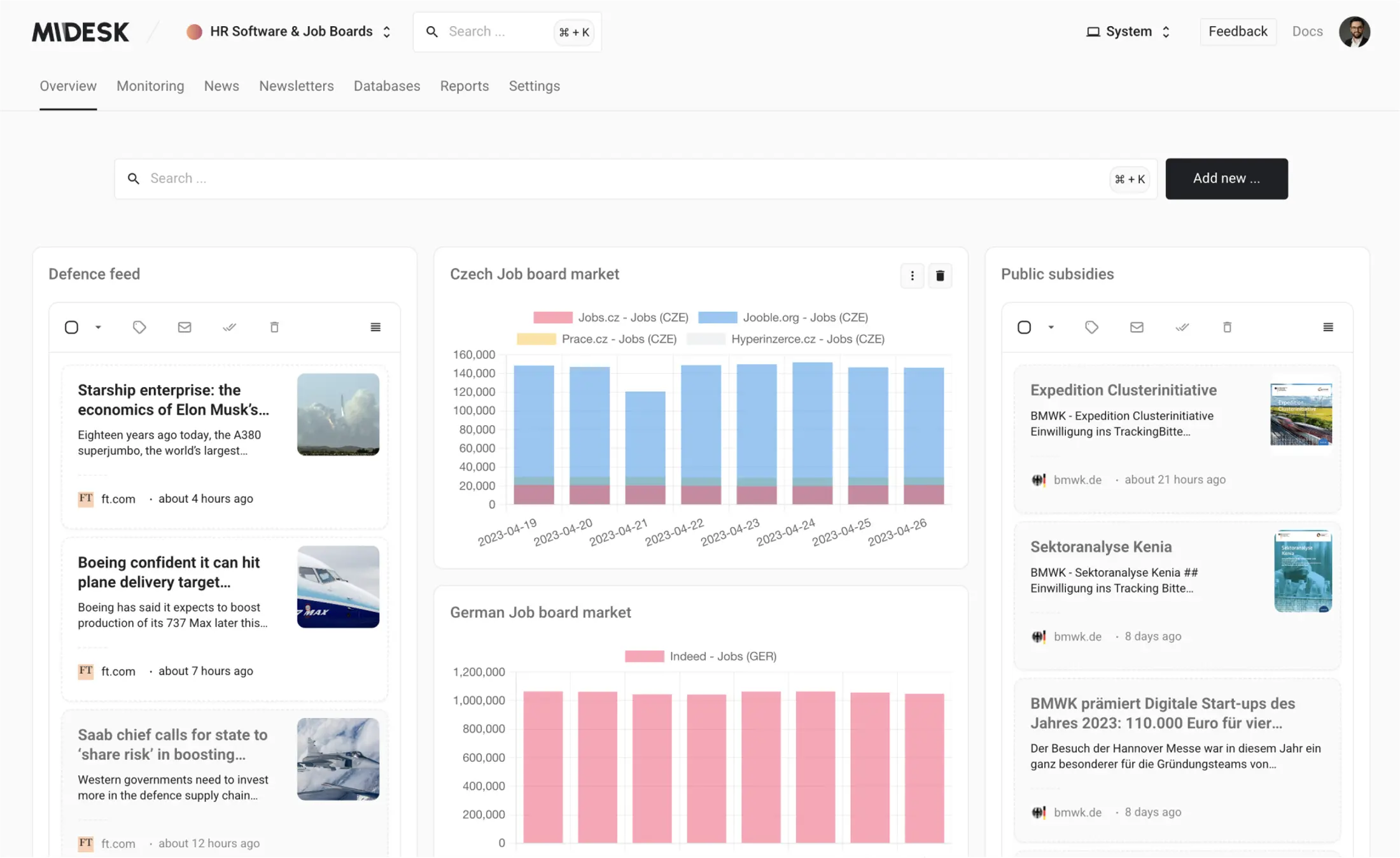

Analysts monitor KPIs, competitor moves, and MCP-ready briefings inside the Midesk workspace.

FAQ

- How large is Brandwatch’s dataset?

- Brandwatch provides access to 1.7 trillion historical conversations and collects about 496 million new posts daily across social media, blogs and forums.1

- Does Brandwatch produce narrative executive briefs?

- No. Brandwatch offers flexible dashboards and exports but does not generate curated, AI‑written briefs with clustering and citations.12

- Can Brandwatch scrape competitor websites or filings?

- Brandwatch focuses on social listening and does not offer a general web‑scraping pipeline; Midesk supports structured scraping for competitor KPIs and filings.4

References

Last reviewed 02/11/2025

- 1. Brandwatch Consumer ResearchBrandwatch20/09/2025Visit source

- 2. AI News Briefs — Executive‑Ready IntelligenceMidesk01/01/2025Visit source

- 3. News Monitoring & Management OverviewMidesk01/01/2025Visit source

- 4. Web & Data Scraping in Competitive & Market IntelligenceMidesk01/01/2025Visit source

Related alternatives

AI-powered market research platform that aggregates over 500 million premium business and financial documents and uses generative AI to synthesize insights across them.[ref:alphasense-platform]

Read comparisonAll‑in‑one PR and media‑intelligence platform that delivers real‑time monitoring across traditional, digital and premium sources, with AI‑powered metrics and outreach tools.[ref:cision-media-monitoring][ref:cisionone-overview]

Read comparisonFormer content‑curation and collaboration platform that helped teams discover, organize and share information using personalized feeds and boards; the company has been discontinued.[ref:tracxn-cronycle][ref:saascounter-cronycle]

Read comparisonAI‑powered market‑intelligence service built on top of Feedly that scans thousands of trusted sources, surfaces emerging trends and lets teams curate insights via dashboards and newsletters.[ref:feedly-ai-feeds]

Read comparisonFree tool from Google that monitors public web content and sends email alerts when new results for chosen keywords appear.[ref:google-alerts-help]

Read comparisonMedia‑intelligence platform that monitors news, social media, broadcast and podcasts across hundreds of thousands of sources and provides alerts, sentiment and trend analysis.[ref:meltwater-coverage][ref:softwareone-meltwater]

Read comparison